How Moving House Affects Your Credit Score?

19th May 2025

Moving house is a significant life event that comes with a long checklist—packing, notifying utility companies, changing your address… and considering how the move might affect your credit score. Many people in the UK overlook this, but understanding how moving house affects your credit score can help you avoid any surprises when applying for credit or financial services in the future.

Does Moving Directly Impact Your Credit Score?

Contrary to popular belief, moving house does not directly reduce your credit score. There’s no penalty from credit reference agencies simply because you’ve changed your address. However, there are indirect ways a move can affect your creditworthiness, especially if certain steps are missed or mishandled.

Updating Your Address Matters

One of the most important things you can do after moving is update your address with all relevant institutions—banks, credit card providers, mobile phone companies, and utility providers. When lenders run a credit check, they want to see consistent and accurate personal information. If your address doesn’t match across your records, it could trigger identity verification issues or lead to a rejected application.

Electoral Roll Registration

Registering to vote at your new address is a crucial part of maintaining your credit score. Being on the electoral roll at your current address improves your credit rating because it helps verify your identity. If you forget to register at your new home, lenders might find it harder to confirm your details, which could delay or negatively impact your applications.

Old Accounts and Missed Payments

When you move, it's easy to lose track of bills or forget to close unused accounts. If you miss a payment or leave an account unpaid at your old address, this will definitely damage your credit score. Setting up mail forwarding and checking all your financial commitments before the move can prevent this.

Multiple Credit Applications

Moving often involves extra expenses—furnishing a new home, paying deposits, or applying for credit to cover moving costs. If you make multiple credit applications in a short space of time, it can temporarily reduce your credit score. Lenders might view this as a sign of financial distress. Try to spread out applications where possible and only apply for credit you genuinely need.

Building Stability Post-Move

Once you've settled into your new home, take steps to stabilise your credit profile. Make sure all your details are up to date, stay on top of payments, and monitor your credit file regularly. A stable address history can help boost your credit score over time.

Conclusion

While moving house doesn’t damage your credit score on its own, failing to keep your financial information current or missing payments during the move can have a negative impact. Take proactive steps, like updating your address and registering to vote, to maintain your credit health. For more tips or to check your score, visit creditcheckonline.co.uk today.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

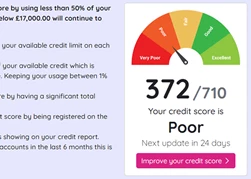

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.