What Does It Mean to Be Credit Invisible in the UK? – Credit Check Online

15th Dec 2025

Being financially responsible does not always guarantee access to credit. Many people in the UK discover they are credit invisible - not because they have missed payments or managed money poorly, but because there is simply not enough recorded credit activity for lenders to assess them. If you have ever tried to check my credit score UK or attempted to credit check online and found little or no information, this guide explains why and how you can address it.

This article also explains how UK credit reports work, how lenders interpret credit invisibility, and how you can safely use a free credit score checker or other tools to become visible over time.

What Does “Credit Invisible” Mean?

In the UK, being credit invisible means that credit reference agencies do not have enough recent or relevant data to generate a meaningful credit profile for you. This usually falls into one of two categories:

- · You have no credit file at all, or

- · You have a very thin or inactive credit file with limited recent activity

When you perform a credit history check UK, lenders expect to see a history of borrowing and repayment. Without this data, risk cannot be accurately measured, even if your finances are stable.

Being credit invisible is not the same as having bad credit. It simply means there is not enough information available for a credit check online or a check my credit score UK inquiry to return results.

Why Credit History Matters in the UK

UK lenders rely heavily on historical patterns. A credit history check UK allows them to assess how consistently someone manages financial commitments.

A typical credit check online in the UK looks at:

- · Length of credit history

- · Types of credit used

- · Repayment behaviour

- · Frequency of applications

- · Stability indicators such as address history

If these signals are missing, automated systems may not be able to score the application. This is why people who try to check my credit score UK sometimes find that no score is displayed. Using a free credit score checker can also help you understand the visibility of your credit history.

Who Is Most Likely to Be Credit Invisible?

Credit invisibility affects a wide range of people, often unintentionally. Common examples include:

- · Young adults who have never used credit

- · New UK residents with no domestic credit history

- · People who rely only on debit cards or cash

- · Self-employed individuals who avoid borrowing

- · Individuals who cleared past credit and stopped using it

Even if someone regularly uses a free credit score checker or attempts to check my credit score UK, they may still find they are invisible due to lack of data.

Students are also often credit invisible because they may not have taken out credit cards or loans yet. They can become visible by opening small credit-building accounts or registering on the electoral roll if eligible.

Why Being Credit Invisible Can Be a Problem

From a lender’s perspective, uncertainty increases risk. Without visible data, lenders may struggle to approve applications for:

- · Mortgages

- · Rental agreements

- · Mobile phone or broadband contracts

- · Car finance or personal loans

- · Certain employment-related credit checks (where legally permitted)

In some cases, a person with a low but active score may be approved more easily than someone who is invisible in a credit history check UK.

How UK Credit Reports and Searches Work

A UK credit report is compiled by credit reference agencies using data reported by banks, lenders, and service providers. When a lender performs a credit check online or a credit search UK, they compare this information against their own lending criteria.

There are two main types of searches:

- · Soft searches, which do not affect your profile

- · Hard searches, which leave a visible footprint

If you are credit invisible, there may be little or nothing for these searches to assess. Regularly using a free credit score checker or performing a check my credit score UK can help monitor your visibility.

Rent and utility payments generally do not automatically appear on your credit report, but some services now report rental payments, which can improve visibility during a credit history check UK.

Credit Invisible vs Low Credit Score

It is important to understand the difference:

- · Credit invisible: Not enough data to generate a reliable score

- · Low credit score: Sufficient data exists, but it indicates higher risk

From a recovery perspective, becoming visible through a credit history check UK or credit check online process is often easier than repairing damaged credit because there is no negative history to correct.

How to Stop Being Credit Invisible

The goal is not to borrow excessively, but to create a small, consistent credit footprint that appears on your UK credit report and can be seen when you check my credit score UK.

Register on the Electoral Roll

This helps lenders verify identity and address stability and is one of the simplest steps you can take.

Use a Credit-Reporting Account

A basic credit product with controlled use can help establish activity, as long as payments are made on time. Monitoring your progress with a free credit score checker ensures your activity is being recorded.

Maintain Light but Regular Usage

Small, manageable activity reported over time is more effective than short bursts of heavy borrowing. Consistent usage will show up when you check my credit score UK or run a credit history check UK.

Avoid Multiple Applications

Too many applications can create unnecessary hard searches during a credit check online process.

Monitor Your Credit File

Regularly performing a credit history check UK and using a free credit score checker helps ensure accuracy and track progress as visibility improves.

Use Credit-Building Tools

Students and newcomers to the UK can use low-limit credit cards or credit-builder loans to safely build visibility. Always pay on time and monitor progress with a credit check online platform or a free credit score checker.

How Long Does It Take to Build Credit Visibility?

Most people begin to see initial visibility within three to six months of reported activity. A more stable profile typically develops within six to twelve months, depending on consistency.

Patience and reliability matter far more than speed. Tools like credit check online platforms or a free credit score checker can help track your progress during this period.

FAQs: Credit Invisible Explained

What does it mean if I cannot check my credit score in the UK?

It usually means there is not enough recorded credit activity for agencies to generate a score. Using a free credit score checker may help verify your visibility.

Does checking my credit score make me visible?

No. Checking your own file through a credit check online or check my credit score UK does not create visibility. Only reported financial activity does.

Can I be credit invisible even with a stable income?

Yes. Income is not automatically included in a credit history check UK.

Is being credit invisible permanent?

No. With consistent, reported activity, most people become visible within a year. Using a free credit score checker regularly helps track improvements.

Will a credit check online affect my profile?

Soft checks do not affect your file. Hard checks leave a visible footprint. Using a credit check online platform can help you monitor safely.

Can students be credit invisible in the UK?

Yes. Many students have little to no credit history, especially if they have not used credit cards or loans yet. They can become visible by opening small credit-building accounts or registering on the electoral roll if eligible.

Does paying rent or bills affect my credit visibility?

Traditional rent and utility payments do not automatically appear on your credit report. Some services now report rental payments to credit reference agencies, which can improve visibility during a credit history check UK.

Can I improve my credit visibility without borrowing?

Yes. You can build credit history by using products like credit-builder cards responsibly, registering on the electoral roll, and keeping accounts active. Regularly performing a credit check online or using a free credit score checker ensures your activity is being reported accurately.

Final Words

Being credit invisible is more common than many people realise, especially among those who avoid debt. While it can limit access to financial products, it is not a negative judgement - it only reflects missing data.

Understanding how UK credit reports, credit history check UK, and credit check online processes work allows you to take controlled steps toward visibility. With clarity, consistency, and time, it is entirely possible to build a healthy and reliable credit profile.

Want to see where you stand? Use our free credit score checker or check my credit score UK tool today to monitor your visibility and take control of your credit journey!

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

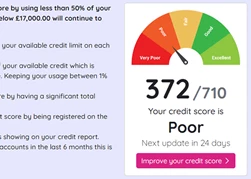

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.