Can You Improve Your Credit Score Without a Credit Card?

31st Jan 2026

Many people in the UK believe that owning a credit card is essential for building a good credit score. While credit cards can help, they are not the only way to improve your credit profile. It is entirely possible to improve your credit score without a credit card by managing other financial commitments responsibly.

How Credit Scores Are Calculated in the UK

UK credit reference agencies assess your credit score based on several factors. These include payment history, credit utilisation, length of credit history, and how often you apply for credit. Importantly, they also consider non-credit commitments such as household bills and financial stability indicators.

This means that responsible financial behaviour, even without a credit card, can still have a positive impact on your credit score.

Using Bills and Regular Payments to Build Credit

Paying regular household bills on time is one of the simplest ways to improve your credit score. Mobile phone contracts, broadband packages, and utility bills reported to credit agencies can all contribute positively.

Setting up direct debits ensures payments are never missed, helping to demonstrate reliability. Some rental payments can also be reported, allowing tenants to build credit without borrowing money.

Managing Existing Credit Responsibly

If you already have loans, overdrafts, or finance agreements, managing them well is crucial. Making payments on time and keeping balances under control shows lenders that you are financially responsible.

Even a small overdraft facility, used carefully and repaid promptly, can help build a positive credit history. Avoid exceeding limits or relying heavily on overdrafts, as this can negatively affect your score.

Keeping Your Credit File Accurate

Errors on credit reports are more common than many people realise. Incorrect addresses, outdated accounts, or wrongly reported missed payments can all damage your score unfairly.

Regularly checking your credit report helps you spot mistakes early. Using tools such as the credit report checker on CreditCheckOnline.co.uk allows you to review your credit information and take action where needed.

Avoiding Unnecessary Credit Applications

Applying for multiple credit products in a short period can lower your credit score. Each application leaves a footprint on your credit file, which lenders may interpret as financial instability.

Being selective and spacing out applications helps protect your score. If you do not need a credit card, focusing on existing commitments is often more effective.

Building a Strong Credit Profile Over Time

Improving your credit score without a credit card takes consistency rather than quick fixes. Stable employment, a fixed address history, and responsible money management all contribute positively. Over time, these behaviours help build trust with lenders, even without revolving credit.

FAQs

Can you have a good credit score without a credit card?

Yes. Many people have strong credit scores through bills, loans, and other regular payments.

Do utility bills affect credit scores?

They can, especially if they are reported to credit reference agencies and paid on time.

Are overdrafts bad for your credit score?

Not if used responsibly. Staying within limits and repaying regularly can be beneficial.

How often should I check my credit report?

At least once a year, or more often if you are planning to apply for credit.

Will avoiding credit cards limit future borrowing?

Not necessarily. A well-managed credit history without cards can still support loan and mortgage applications.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

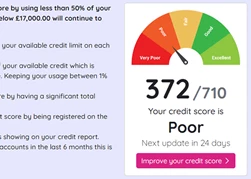

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

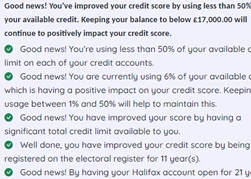

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.