5 Smart Ways Students Can Start Building Credit Early

2nd Aug 2025

For students in the UK, building credit early is one of the smartest financial decisions you can make. A strong credit score can make a real difference later in life - from renting a flat and securing a mobile contract to getting a loan or mortgage. While it may seem daunting at first, there are several easy and responsible ways students can start laying the foundations of a healthy credit profile.

Below are five useful tips to help you get started.

1. Open a Student Credit Card (Responsibly)

Many UK banks offer student credit cards with low credit limits and competitive rates. These cards are designed specifically for first-time borrowers. By using a student credit card for small monthly purchases - like groceries or travel - and paying it off in full each month, you can begin to build a positive credit history.

Tip: Always stay well below your credit limit and avoid interest charges by clearing the balance on time.

2. Register on the Electoral Roll

One of the easiest but often overlooked options to improve your credit profile is to register to vote. Credit agencies use the electoral roll to verify your identity and address history. Being on it can significantly boost your creditworthiness.

You can register for free via gov.uk/register-to-vote.

3. Use a Free Credit Score Checker

Monitoring your credit score regularly helps you understand where you stand and what’s influencing your rating. Tools like CreditCheckOnline.co.uk’s free credit score checker allow you to check credit online without affecting your score. It’s a good habit to check your credit report at least once a month for any errors or unusual activity.

Look out for:

- · Missed payments

- · Inaccurate personal details

- · Unexpected credit applications

Correcting errors early can prevent problems down the line.

4. Pay Bills on Time - Even Small Ones

Whether it’s a phone bill, utility account, or subscription service, paying bills on time is essential. Missed or late payments can negatively affect your credit score and stay on your report for up to six years.

Set reminders or use direct debits to avoid missing due dates. Regular, timely payments show lenders you can manage financial responsibilities.

5. Consider a Credit-Builder Loan or Card

If you're finding it difficult to get approved for standard credit products, look into credit-builder loans or cards. These are designed for people with little to no credit history and can be a stepping stone to more mainstream financial products.

Before applying, check your credit report to see where you stand. Using a free credit score checker is a risk-free way to gauge your eligibility and plan accordingly.

Conclusion:

Building credit as a student doesn’t require complex strategies - just consistent, responsible habits. By starting early, you’ll be in a stronger financial position when it matters most, whether you're applying for a car loan, renting your first flat, or even securing a job that runs credit checks.

If you don't have a clue about your current situation and want to check it out effectively, start by using a reliable tool to check credit online and monitor your progress month by month. A little effort now can make a big impact on your financial future.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

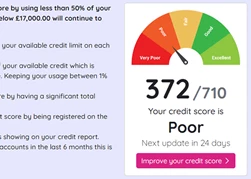

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

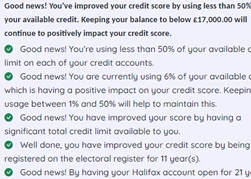

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.