What Landlords See in a UK Credit History Check

28th Jul 2025

When applying to rent a home in the UK, your credit history plays a much bigger role than you might think. Landlords want reassurance that you’ll be a reliable tenant, and one of the main ways they assess that is through a credit history check UK.

But what exactly do landlords see in a credit check online? Does your credit score check include every financial detail? Will a low score hurt your chances - or can you still rent with a poor rating?

In this blog, we break it all down, showing you exactly what to expect from a credit check online, how to check your credit score, and how to use a free credit score checker to prepare in advance.

Why Landlords Use a Credit History Check UK-Wide?

Renting is a significant financial agreement, and landlords want to minimise risk. A credit history check UK helps landlords decide if a tenant is financially trustworthy. While you might think of credit check online tools for loans or mortgages, they’re just as crucial when renting.

Landlords rely on:

- · Your credit report history

- · Evidence of missed or late payments

- · Public financial records (e.g., CCJs, bankruptcies)

- · Identity and address confirmations

That’s why it’s smart to check your credit score before applying. You can use a free credit score checker to get a clear view of what a landlord might see in a credit score check.

What Do Landlords See in a Credit Check Online?

Most landlords don’t see your full credit score number. Instead, they receive a tenant-specific summary from referencing agencies after performing a credit history check UK. The information includes:

✅ Credit Accounts and Payment History

Landlords can spot late payments, defaults, or missed bills. If you’ve ever wondered, “Should I check my credit score before applying?” - the answer is yes.

✅ Public Records

Your credit report history shows any bankruptcies, Individual Voluntary Arrangements (IVAs), and County Court Judgments (CCJs). These can impact your ability to rent - even if they’re several years old.

✅ Identity and Address Checks

Landlords want proof of consistency in your address history. A check credit report history will highlight address discrepancies and confirm identity.

Do Landlords See My Exact Credit Score?

Not usually. They may receive a simple “pass/fail” result based on your credit history check UK. But some landlords or letting agents may request more detailed information - especially if they handle referencing themselves.

That’s why it’s important to check your credit score regularly using a free credit score checker. Knowing what shows up during a credit check online helps you prepare and correct anything inaccurate.

If you haven’t already, check my credit score is the first step every tenant should take.

How to Check Your Credit Score Before Renting?

A credit check online doesn’t have to be confusing or costly. Here's how to check your credit score in just a few minutes:

1. Use a Free Credit Score Checker

Go to CreditCheckOnline.co.uk, where you can instantly check your credit score for £1.95. The platform is designed specifically for UK users, making it perfect for renters.

2. Review Your Credit Report History

Look for any red flags like late payments, unpaid accounts, or outdated details. Your credit report history is crucial to landlords, so correct anything that might be misleading.

3. Monitor Your Score Monthly

Using a free credit score checker means you can track improvements over time. Make it a habit to check my credit score UK each month - especially before applying for a rental.

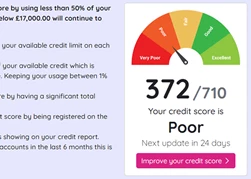

What Counts as a Bad Credit Score for Renting?

Lenders and referencing agencies all score differently, but here's a general guide for UK credit scores:

· Excellent (800+) - Very strong chance of rental approval

· Good (700-799) - Safe zone

· Fair (600-699) - May need a guarantor

· Poor (Below 600) - Risk of being declined or needing upfront rent

Before you apply for a rental property, check my credit score UK to see where you stand. If your credit score check shows issues, work on them before applying.

Improve Your Credit Before a Rental Application

You’ve run your credit check online and your score isn’t ideal. Don’t worry - here’s how to fix it:

1: Register on the Electoral Roll

Many don’t realise how this boosts your credit history check UK profile. It confirms address stability - something landlords value.

2: Pay Off Small Debts

Even one overdue bill can damage a credit score check. Clear those up before applying.

3: Limit Credit Applications

Too many “hard checks” can hurt your score. Don’t apply for loans, credit cards, or other borrowing just before you check credit score in UK.

4: Use a Guarantor

Some landlords may overlook a poor credit history check UK if a guarantor with good credit backs you.

Can I Still Rent with a Poor Credit Score?

Yes - if you take the right steps. While a bad credit score check can be a barrier, you can still succeed by:

- · Offering a larger deposit

- · Paying rent upfront (e.g., 6 months)

- · Providing proof of stable income

- · Sharing your credit report history transparently

In every case, check credit report history before you even contact a landlord. Be ready to explain what they’ll see and how you’ve improved your credit.

How Often Should I Check My Credit Score?

You should check your credit score at least once a month. Regular checks help you:

- · Spot fraud early

- · Correct inaccuracies

- · Improve your score strategically

- · Prepare for applications

There’s no harm in running a credit check online using a free credit score checker - it won’t affect your score. So go ahead and check my credit score UK before you rent.

FAQs: Credit History Check UK for Tenants

❓ Does checking my score hurt it?

Answer: No - using a free credit score checker is a soft inquiry. You can check your credit score as often as you like.

❓ What’s the difference between a landlord check and my own?

Answer: Landlords see a rental-friendly version of your credit report history, while you see everything. That’s why it’s smart to check my credit score before they do.

❓ Can I rent if I’ve never had credit?

Answer: Yes, but a credit history check UK may come back thin. In this case, a guarantor or upfront payment helps.

Conclusion: Know What Landlords See Before You Apply

Your credit history can shape your chances of renting - but you’re not powerless. Before applying, take time to:

- · Run a credit check online

- · Use a free credit score checker

- · Review your credit report history

- · Resolve issues or prepare a guarantor

Don't wait until rejection to wonder, “Should I check my credit score?” - be proactive.

👉 Start your journey today with a full credit history check UK at CreditCheckOnline.co.uk - and get peace of mind before your next rental.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.