Credit Scores and Employment: Do Employers Really Check?

16th Jun 2025

In today’s competitive job market, employers are becoming increasingly thorough during the recruitment process. While background checks and references are standard, many jobseekers in the UK wonder: Do employers really check your credit score? Let’s explore the connection between credit scores and employment—what’s checked, why it matters, and when it may be a concern.

Do Employers Check Your Credit Score in the UK?

In most cases, employers in the UK do not perform a full credit check as part of a standard hiring process. However, there are exceptions. If you're applying for a role that involves financial responsibilities—such as positions in banking, accounting, or senior management—a credit check may be carried out.

It’s important to understand that employers cannot view your full credit score or financial details without your consent. Instead, they conduct what's called a soft credit check, which shows public financial information such as:

-

County Court Judgments (CCJs)

-

Bankruptcies or Individual Voluntary Arrangements (IVAs)

-

Electoral roll information (used to confirm your address)

Why Employers Might Check Your Credit

There are legitimate reasons an employer might need to look at your financial background. These include:

-

Trustworthiness in Financial Roles: For jobs where you're handling large sums of money or financial records, employers may want reassurance that you can manage finances responsibly.

-

Security Clearance: Government or defence-related roles often require checks that include financial history to prevent vulnerability to bribery or corruption.

-

Regulatory Compliance: Some roles are regulated by the Financial Conduct Authority (FCA), which mandates credit checks to meet industry standards.

Does a Poor Credit Score Affect Your Job Chances?

A bad credit history won’t automatically disqualify you from most jobs. Employers are primarily looking for signs of financial irresponsibility that might affect job performance in specific roles. However, in sensitive positions, serious issues like bankruptcy or repeated defaults could raise concerns.

That said, most employers also take context into account. If your financial issues are due to circumstances beyond your control (e.g. medical bills, redundancy), it may not carry the same weight.

Your Rights as a Jobseeker

Under UK law, employers must obtain your permission before conducting any form of credit check. You also have the right to:

-

Know what information has been checked

-

Challenge inaccurate information

-

Request a copy of the data used in the decision

If a credit check impacts a hiring decision, the employer should be transparent about it.

Final Thoughts

While credit scores and employment may be linked in certain sectors, for most jobseekers, it’s not something to worry about. It’s always wise to regularly check your credit report for inaccuracies and keep your finances in good shape—whether or not a potential employer is looking.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

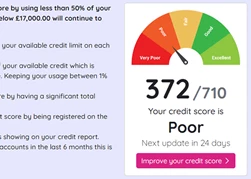

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.