Understanding Your Credit Score

30th May 2025

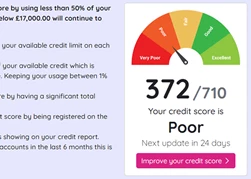

Credit scores are generated by the UK’s credit reference agencies and are expressed as a three-digit number. When you apply for credit, lenders and service providers look at your credit score as part of their decision-making process. If your credit score is high or rated “very good” or “excellent”, you're more likely to be offered lower interest rates and higher credit limits. On the other hand, a low credit score could make you appear as a higher risk to lenders. You can improve your credit score over time by managing your accounts responsibly and avoiding applying for too many credit products.

Where Do I Find My Credit Score?

In the UK, there are three main credit reference agencies: Experian, Equifax, and TransUnion. Although the scale each one uses is different, the ranking of poor to excellent is standard across all three. Your credit score reflects how likely you are to pay a loan back, based on your history of managing credit and finances. A higher credit score means you're more likely to be accepted for credit, but it’s not a guarantee.

How Does a Credit Score Work?

Credit reference agencies gather information from various sources that can influence your credit score, including:

- Types of accounts: A mix of credit accounts, such as a mortgage and credit cards, shows you can manage different types of borrowing.

- Electoral register: Being listed on as a voter at your home address helps confirm your identity and address, which improves your credit score.

- Court records: Defaults, County Court Judgements (CCJs), Individual Voluntary Arrangements (IVAs), and bankruptcy can negatively impact your score for up to six years.

- Spending habits: Maxing out your credit cards or only ever making the minimum payment may raise concerns that you are depending on credit to fund your lifestyle, which rings alarm bells.

- Account history: Older accounts show you have experience managing credit and a longer track record, which gives lenders confidence in giving you more money.

- Prompt Payments: Credit reference agencies look at missed, late, or defaulted payments, as well as any times you exceed your credit limits. This can harm your score.

How is a Credit Score Graded?

Each credit reference agency uses a different scale, but generally speaking, the higher your score, the better your chances of being accepted for credit. One good way of working out whether you stand a good chance of being accepted for credit is by running a soft credit check, or eligibility checker, to see what your chances are before making a firm application.

If you can’t find many good options for a new car loan or credit card because your score is too low, then often the best tactic is to take some time out. Changes which you make will affect your credit score but won’t be reflected instantly, so give it six months and then take a look again. Careful financial management should see your credit score improve over time, and the longer you can keep your finances stable, the better it will get.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.