Electoral Roll and Credit Scores: Why Registration Matters

13th Aug 2025

Your credit score is a key factor in whether lenders approve you for loans, credit cards, or mortgages. While many people focus on paying bills on time and reducing debt, there’s one often-overlooked factor that can make a big difference – being on the electoral roll. In the UK, your electoral roll status is more important to your credit score than you might think.

What Is the Electoral Roll?

The electoral roll, also known as the electoral register, is an official list of everyone registered to vote in the UK. It contains your name, address, and details of your voting eligibility. Local councils maintain this register, and it’s updated regularly.

Aside from enabling you to vote in elections, the electoral roll is also used by various organisations – including credit reference agencies – to verify your identity and address.

How the Electoral Roll Affects Your Credit Score

Credit reference agencies like Experian, Equifax, and TransUnion check the electoral roll to confirm your personal details. This simple verification helps lenders trust that you are who you say you are and that you live at the address provided.

When you are registered on the electoral roll:

-

Lenders can quickly confirm your identity.

-

Your application process is smoother and faster.

-

You are seen as more stable and trustworthy.

Being absent from the electoral roll can raise a red flag, making lenders less confident in your application and potentially lowering your credit score.

Why Lenders Value Electoral Roll Data

Lenders use electoral roll information to reduce the risk of fraud. If your identity or address cannot be confirmed, they may be reluctant to offer you credit. Stability is an important factor in lending decisions, and being registered to vote shows that you have a fixed residence.

In short, being on the electoral roll makes you easier to identify and less risky to lend to.

How to Check If You’re Registered

You can check your registration by contacting your local council’s Electoral Services team or visiting the government’s voter registration website. You’ll need to provide basic details such as your name, date of birth, and current address.

If you’ve moved recently, remember that registration doesn’t update automatically – you must re-register at your new address.

How to Register for the Electoral Roll

Registering is quick and free. Simply visit the official government site (gov.uk/register-to-vote) and fill in your details. You’ll need your National Insurance number and current address. Registration deadlines apply before elections, but you can update your details at any time.

Final Thoughts

When it comes to Electoral Roll and Credit Scores: Why Registration Matters, the message is clear – being on the electoral roll is one of the easiest ways to improve your credit profile. It helps lenders verify your details, speeds up applications, and signals stability.

If you’re aiming for a healthier credit score, make sure you’re registered – it’s a small step that can have a big impact on your financial future.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

An Independent View Of Your Credit Score

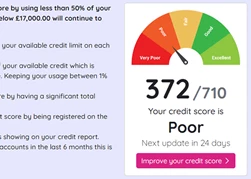

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

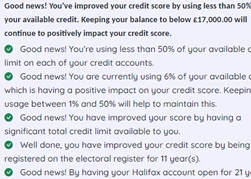

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.