Credit Freeze vs. Credit Lock: What's the Difference and When to Use Them?

8th Aug 2025

With rising cases of identity theft and financial fraud, UK consumers are increasingly seeking ways to protect their credit files. Two popular tools are the credit freeze and the credit lock. While both aim to restrict access to your credit report, they work differently and may be suitable for different situations.

In this article, we’ll break down the key differences between a credit freeze and a credit lock, their pros and cons, and when you should consider using them.

What Is a Credit Freeze?

A credit freeze, sometimes called a “security freeze”, is a free service offered by UK credit reference agencies such as Experian, Equifax, and TransUnion. When you place a freeze on your credit file, it restricts lenders and creditors from accessing your report without your consent.

This means fraudsters cannot open new accounts in your name, as most lenders require a credit check before approving applications.

To unfreeze your credit, you must contact the credit reference agency directly. This process may take a day or two, making it a more secure but slightly less flexible option.

What Is a Credit Lock?

A credit lock serves the same basic purpose as a credit freeze – preventing unauthorised access to your credit report – but it offers greater convenience. With a credit lock, you can lock and unlock your credit file instantly, often through a mobile app or online account.

However, unlike a credit freeze, credit locks may come with a fee or be available only as part of a paid subscription service. Some credit agencies in the UK include credit lock features in premium identity protection packages.

Key Differences Between Credit Freeze and Credit Lock

While they serve the same purpose, the main differences are:

-

Cost: Credit freezes are free by law, while credit locks may involve a subscription fee.

-

Activation Time: Credit freezes require contacting the agency and may take up to 24–48 hours to lift; credit locks can be switched on/off instantly.

-

Legal Protection: A credit freeze is a legal right, offering stronger regulatory protection. Credit locks are contractual services with the credit agency.

When to Use a Credit Freeze

A credit freeze is best if:

-

You suspect you’re a victim of identity theft.

-

You rarely apply for new credit accounts.

-

You want a free and legally enforceable method to protect your credit file.

It’s ideal for long-term protection, as you can lift the freeze temporarily when applying for new credit.

When to Use a Credit Lock

A credit lock may be a better option if:

-

You apply for credit more frequently and need flexibility.

-

You prefer the convenience of instant locking/unlocking.

-

You already subscribe to an identity protection service that includes a lock feature.

Final Thoughts

Both a credit freeze and a credit lock can effectively safeguard your credit report from fraudsters. If you value maximum protection at no cost, a credit freeze is the way to go. If you want speed and convenience, a credit lock might suit you better.

For more tips on protecting your financial identity, visit creditcheckonline.co.uk.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

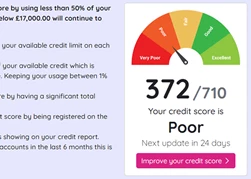

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.