Payday Loans and Credit Scores: The Long-Term Impact

4th Jun 2025

Payday loans may seem like a quick fix when you're strapped for cash, but they can have a significant and lasting impact on your credit score. In the UK, many people turn to these short-term loans to cover emergency expenses, unaware of how they can affect future financial opportunities. In this article, we explore the relationship between payday loans and credit scores—and what you need to know before applying.

What Are Payday Loans?

Payday loans are high-interest, short-term loans designed to be repaid by your next payday. They are commonly used to cover unexpected expenses or temporary cash flow issues. While they are quick and convenient, they often come with high fees and interest rates, making them an expensive form of borrowing.

How Payday Loans Appear on Your Credit Report

When you take out a payday loan, it is recorded on your credit report like any other form of borrowing. Lenders can see this information when you apply for credit in the future. Even if you repay the loan on time, the fact that you’ve used payday lending can raise red flags to banks and mortgage lenders. It suggests that you may have difficulty managing your finances or relying on high-cost borrowing to get by.

The Long-Term Impact on Your Credit Score

Although taking out a payday loan won’t automatically damage your credit score, it can affect it in several indirect ways:

-

Multiple Payday Loans: Frequent borrowing can make you appear financially unstable.

-

Missed Repayments: If you miss a payment, it will be recorded as a negative mark on your credit file.

-

Loan Defaults: Failing to repay can result in default notices or County Court Judgements (CCJs), which significantly harm your score.

-

High Credit Risk: Some lenders may reject mortgage or loan applications simply because you've previously used payday loans.

How Long Does the Impact Last?

Information about payday loans can remain on your credit file for six years, even after the loan is fully repaid. This means future lenders, landlords, and even employers (in some sectors) could see your borrowing history long after you've moved on.

How to Minimise the Damage

If you’ve already used a payday loan, here are a few ways to reduce the long-term impact:

-

Pay on time: Timely repayments can prevent negative marks on your credit file.

-

Avoid repeated use: Use payday loans only as a last resort.

-

Check your credit report regularly: Use platforms like CreditCheckOnline.co.uk to monitor your credit standing.

-

Build positive credit history: Take steps to rebuild your credit by using responsible forms of borrowing and paying all bills on time.

Final Thoughts

While payday loans may seem like a convenient solution, they can have far-reaching consequences. The way they influence your credit score can affect your ability to borrow for years. Before turning to this type of loan, consider all alternatives and understand the full impact it may have on your financial future.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

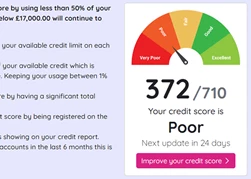

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.