Store Cards vs Credit Cards: Which Is Better for Your UK Credit Score?

When you’re at the checkout in Argos, Marks & Spencer, or John Lewis and the cashier offers 10% off with a new store card, it can be tempting to accept. But before you sign up, it’s important to understand how store cards compare to traditional credit cards - and which option is better for your UK credit score. [more...]

Redundancy and Your UK Credit Score Check: What to Monitor

Redundancy can bring sudden financial uncertainty, particularly when it comes to managing existing credit commitments. While losing a job is emotionally challenging, it can also place pressure on your finances, making it harder to stay on top of payments and borrowing. As a result, many people worry whether redundancy will affect their ability to check my credit score UK or whether it could permanently damage their financial record. [more...]

The Impact of Multiple Loan Applications on Your Credit Rating

Applying for credit is a normal part of managing your finances, whether you are looking for a personal loan, car finance, or a mortgage. However, many people are unaware that making several loan applications in a short period can negatively affect their credit profile. Understanding the impact of multiple loan applications on your credit rating can help you make smarter financial decisions and protect your future borrowing power. [more...]

What Happens to Your Credit Score After Bankruptcy is Discharged?

Bankruptcy can feel like a financial reset, but many people wonder what actually happens to their credit score once bankruptcy is discharged. In the UK, discharge usually occurs 12 months after bankruptcy begins, marking the end of most restrictions. However, the impact on your credit score does not disappear overnight. [more...]

Do Car Insurance Quotes Affect Your Credit Score? The Ultimate 2026 Guide

Every year, millions of UK drivers use comparison websites to find better car insurance premiums. As you enter your details, a common question arises: “Will getting all these quotes damage my rating?” Protecting your creditworthiness is essential, especially if you plan to buy a home, apply for a loan, or take out other credit. [more...]

Does Divorce Affect Your Credit Score? What Every UK Couple Needs to Know

Divorce can be one of life’s most stressful events, not just emotionally, but financially. Many people ask, “Does getting a divorce directly lower my credit score?” While your marital status itself does not appear on your credit report, the financial consequences of separation can indirectly affect your rating. [more...]

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

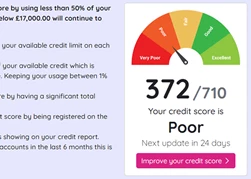

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

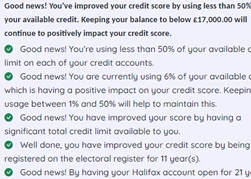

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.