How Long Do Defaults Stay on Your Credit Report in the UK?

Defaults can significantly affect your ability to borrow money or access credit in the UK. Understanding how long they remain on your report, and how to recover from them, is essential for managing your financial health. [more...]

Does Buy Now, Pay Later Affect Your Credit Score?

In today’s online world, credit impacts almost every financial decision you make - from car insurance to mortgages. That’s why it’s crucial to check your credit score regularly and stay aware of how services like Buy Now, Pay Later (BNPL) influence it. [more...]

The Smart Way to Manage Multiple Credit Cards

It’s common to have more than one credit card - perhaps one for travel, one for groceries, and another for emergencies. But juggling multiple accounts without structure can lead to missed payments or rising debt. That’s where the smart way to manage multiple credit cards comes in - through discipline, planning, and regular monitoring using Credit Check Online tools. [more...]

Why Millennials and Gen Z Think Differently About Credit

Credit has always been the foundation of financial opportunity - from buying a home to leasing a car. But the digital generation has redefined what it means to be credit-savvy. Millennials and Gen Z don’t view credit the same way as their parents did. Today’s world is faster, smarter, and more connected - and younger consumers prefer to check credit online, track financial habits, and rely on a free credit score checker to stay informed. [more...]

The Link Between Credit Score and Car Insurance Rates

When people think about what determines the cost of car insurance, most focus on driving history, age, postcode, or vehicle type. However, another important factor affects how much you pay - your credit score. Understanding the link between credit score and car insurance rates can help you make smarter financial decisions and save significantly on your premiums. [more...]

Understanding Your Rights When Dealing With Debt Collectors

Dealing with debt collectors can be intimidating. Unexpected calls or letters can cause anxiety, especially if you’re unsure about what they’re legally allowed to do. But the good news is that you have strong consumer rights - and understanding them can protect you both financially and emotionally. [more...]

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

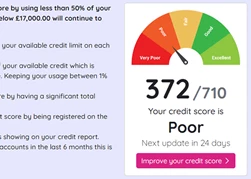

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

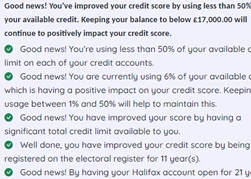

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.