Understanding Soft vs Hard Credit Checks: What You Need to Know

4th Aug 2025

When you apply for a credit card, mortgage, or even a phone contract, the lender needs to know how reliable you are with money. That’s where a credit check comes in. But not all credit checks are the same.

There are two types: soft checks and hard checks. Knowing the difference between a soft vs hard credit check can help you protect your credit score and make better financial choices.

What Is a Credit Check?

A credit check is when a lender or company looks at your credit report to understand your borrowing history. Your report includes information about loans, credit cards, missed payments, and even your address history.

Credit checks are used by banks, landlords, utility companies, and even some employers. Your report is managed by UK credit reference agencies like Equifax, Experian, and TransUnion.

You can also use services like CreditCheckOnline.co.uk to check credit online safely and see what lenders see.

What Is a Soft Credit Check?

A soft credit check is a quick look at your credit report that doesn’t affect your score. It’s only visible to you, not to other lenders.

Soft checks are used for:

- · Checking your own credit score

- · Eligibility checks (before applying for credit)

- · Some employer background checks

If you’re using a free credit score checker, it’s doing a soft check. These are safe, and you can use them as often as you like.

What Is a Hard Credit Check?

A hard credit check happens when you apply for credit – like a loan, mortgage, or new phone contract. It’s a full review of your report and can temporarily lower your score.

Hard checks are recorded and visible to other lenders. Too many of them in a short time can make you look desperate for credit, which may reduce your chances of being approved.

Examples of when hard checks happen:

- · Applying for a credit card

- · Getting car finance or a mortgage

- · Starting a new mobile or broadband plan

- · Using "Buy Now, Pay Later" services

Can You Check Your Score Without Hurting It?

Yes! You can check credit online without damaging your score. Sites like CreditCheckOnline.co.uk let you monitor your credit with a soft check, so there’s no risk to your report.

It’s a good idea to keep track of your score regularly. This helps you:

- · Spot errors or identity fraud early

- · Track your progress as you build credit

- · See what lenders see before you apply

How Many Hard Checks Is Too Many?

One or two hard checks in 6 months is usually fine. But if you apply for lots of credit in a short time, it can lower your score and raise red flags for lenders.

Tip: When comparing loans or cards, use an eligibility checker first. These tools use soft checks, so there’s no harm to your score.

What To Do Before You Apply for Credit?

Before applying for any credit product:

- · Use an eligibility checker to see your chances

- · Check your credit report for errors

- · Pay off existing debt, if possible

- · Avoid applying for several things at once

These steps help you appear more reliable and increase your approval chances.

How Long Do Credit Checks Stay on Your Report?

- · Soft checks: Only visible to you and disappear after 12 months

- · Hard checks: Stay for up to 12 months and may affect your score for 3-6 months

Over time, your score will improve as long as you manage your credit responsibly - pay on time, don’t max out your cards, and avoid missed payments.

Conclusion:

Understanding soft vs hard credit checks helps you stay in control of your financial health. Use tools like a free credit score checker to stay informed and track your progress.

When you’re ready to apply, take your time, check your credit online, and avoid unnecessary hard checks. The better your credit history, the better your chances of getting approved - and with better rates.

Don't risk missing

something important

Access a comprehensive credit report

that includes detailed data from TransUnion

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.

See How You Score

See How You Score

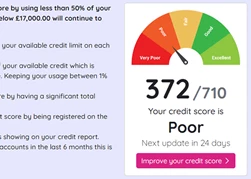

An Independent View Of Your Credit Score

Lenders typically use their own systems to calculate your Credit Score based on the information in your Credit Report, often checking with one or more Credit Reference Agencies. Your Credit Check Online Credit Score is derived from all the Credit Report information we gather from TransUnion, helping you understand how you might be assessed when applying for credit.

Understand What is Affecting Your Credit Score

Quickly see how the details in your Credit Report influence your Credit Check Online Credit Score, both positively and negatively. This clear overview helps you identify areas for improvement and better understand the factors that lenders consider when assessing your creditworthiness.

View your credit score for only £1.95.

You can view it for 1 month, after which it will be £14.95 per month unless cancelled.